With trading volume down nearly 97 percent from record highs, the NFT market has evolved beyond its hype-fueled infancy and now enters an awkward adolescence.

Yet the dramatic NFT boom and bust of the past year has had less of an impact in the fine arts space, where museums and galleries continue to adopt digital art NFTs both as a credible genre for curation as well as a much-needed revenue stream. This week, the New York Times highlighted the rising status of digital art and artists and “warm reception” from major museum curators eager to attract new audiences as well as potential donors who made their fortunes during the NFT boom of 2021. This indicates a yawning credibility gap in which “NFTs” are associated with cartoonish memes, rampant speculation, and pervasive scamming, yet “digital art” is an increasingly legitimate segment for museums and galleries in need of post-pandemic revenue and footfall.

As Christiane Paul, the digital art curator at New York’s Whitney Museum, put it, “On the upside, NFTs have generated more interest and awareness for digital art […] But one of my pet peeves is how people now equate digital art with JPEGs and spinning little GIFs when it’s a medium that has a 60-year-long history that consists of everything from algorithmic drawings to internet art.”

The institutional need to ramp up revenue has become particularly true over the past three years, as museums and gallery budgets tightened amid stagnant footfall and intrepid (and sometimes newly hired) curators started to embrace digital art — as well as virtual reality and other Web3-adjacent segments — to connect with younger audiences. Branching into the tech world has also opened otherwise staid, traditional institutions to funding from companies interested in donations or sponsorships.

For example, the Guggenheim Museum recently announced a five-year collaboration with the South Korean electronics brand LG designed to “research, honor and promote artists working at the intersection of art and technology,” and which includes a $100,000 annual award funded by LG that recognizes one artist per year for their “groundbreaking achievements in technology-based art.” LG is also funding the hiring of an “LG Electronics Assistant Curator,” a newly-created, research-based position that will “develop and support the Guggenheim’s engagement with digital and technology-based art,” working under the supervision of the Guggenheim’s senior curatorial staff.

Beyond making themselves attractive to sponsors or patrons outside of the art world, phasing digital art into their broader strategy is a way for institutions to increase revenue through profit-sharing arrangements. Last year, a collaboration between New York’s Museum of Modern Art (MoMA) and Turkish-American artist Refik Anadol saw Anadol feed hundreds of thousands of images from MoMA’s archives into a machine-learning model to produce digital artworks that were then sold as NFTs. The result was a financial success, with one of the NFTs selling for $200,000.

But more importantly for MoMA, which has faced a decrease in footfall over the past two years, the collaboration included a revenue share of 17 percent of all primary sales and 5 percent of secondary sales. Even in the current “crypto winter,” it’s not irrational to think more museums might decide to follow suit by collaborating with hot digital artists and sharing in the profits of any sales.

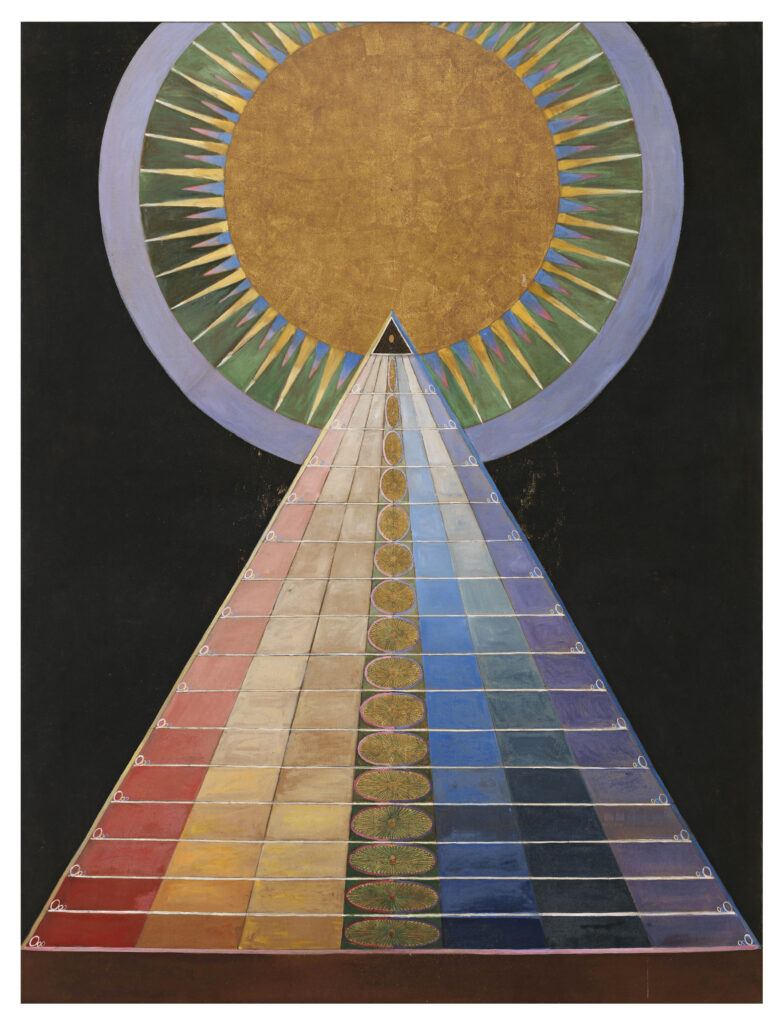

Hilma af Klint, Altarpiece, No. 1, Group X, Altarpieces, 1907. Image: Wikimedia Commons

Whether or not they’re explicitly referred to as such, NFTs are also proving a way to expose audiences to new artists, living or dead. Later this month, Goda (Gallery of Digital Assets) — the digital art platform launched earlier this year by Pharrell Williams — will drop an edition of 193 digitized paintings by the late Swedish artist Hilma af Klint (1862-1944), whose work has been rediscovered in recent years by a new generation of art lovers.

As the Art Newspaper noted of the artist, “[Af Klint’s] work — graphic, colourful and deeply idiosyncratic — has demonstrated a Van Gogh-like power to generate footfall and has given rise to projects across multiple formats, from books and films to experiences in virtual and augmented reality (VR/AR).” Offering the chance to own — in digital form — and, by way of VR extensions, experience an entire collection by a particular artist can give audiences a new appreciation for the artwork, rather than just the ability to display it (on-screen) at home.

These extensions indicate considerable opportunities for institutions on the micro-level, insulating them from a broader NFT market decline. But moving forward, the question is what this really could mean for the future of digital art NFTs: a continued slide in the value of cartoon or meme NFTs and stable or very gradually increasing value for digital art with the institutional “stamp of approval”?

In the latter scenario, the NFTs will function more like China-style “digital collectibles” for many buyers — purchased out of interest or passion — rather than speculative vehicles. Imagine buyers collecting NFT collections as souvenirs of an exhibition like they once purchased exhibition books or posters in museum gift shops, without consideration of potential future resale.

The British Museum faced criticism for the increase in its carbon footprint after offering NFTs last year. Image: Shutterstock

For art institutions, the benefits of adopting NFTs — however they refer to them — are relatively straightforward, offering revenue and new ways to attract audiences, raise funds for maintenance, and court potential sponsors and donors. But they’re not risk-free. Ethical concerns are some of the most often-cited risks to institutions, with a panel at this year’s MuseumNext Digital Summit pointing out that “the world of cryptocurrency can challenge the ethics of museums when it comes to selling NFTs,” and “[the] anonymity of crypto sales often means it’s difficult to know where the money is coming from.” (A potential area of concern if a museum were to receive anonymous crypto donations, for example.)

Integrating NFT sales or, in essence, anything Web3-related also opens institutions up for criticism from groups concerned about the environmental impact of these technologies. Earlier this year, this criticism was leveled against the British Museum, with one article projecting the institution’s NFT project sent its carbon footprint “soaring” since its launch in September 2021.

Yet if art institutions are able to sidestep the toxic connotations of the term “NFT,” address the environmental component by using less energy-dependent proof-of-stake blockchain systems, and focus on the benefits for collectors (whether they offer exclusive perks, interesting ways to experience the artwork, a “phygital” component, or something else), much longer-term value can be had for the institution as well as the collector.