Another day, another non-fungible token (NFT) — so goes the story of the art world in 2021 thus far. A year of working, socializing, and entertaining ourselves online seems to have rendered the prospect of collecting virtual assets a logical next step, rather than the cognitive leap it might have seemed to many pre-pandemic.

NFTs are not new, but have broken into mainstream consciousness through a virtuous circle catalyzed by an (un)healthy dose of celebrity fanfare, the embrace of contemporary artists, and speculative tech dollars. Most recently, a work by street artist Banksy was burned and turned into an NFT that sold for $380,000, the inaugural digital art auction by Christie’s saw a Beeple collage sell for $69 million, and Beijing’s UCCA Center for Contemporary Art has announced the world’s first major crypto art exhibition.

Beyond the art world, NFTs include, well, virtually everything: a LeBron James dunk, Jack Dorsey’s first tweet, and Lindsay Lohan’s “Lightning” images.

But what exactly are NFTs, where did they come from, and why do they matter for the art world?

What are NFTs?

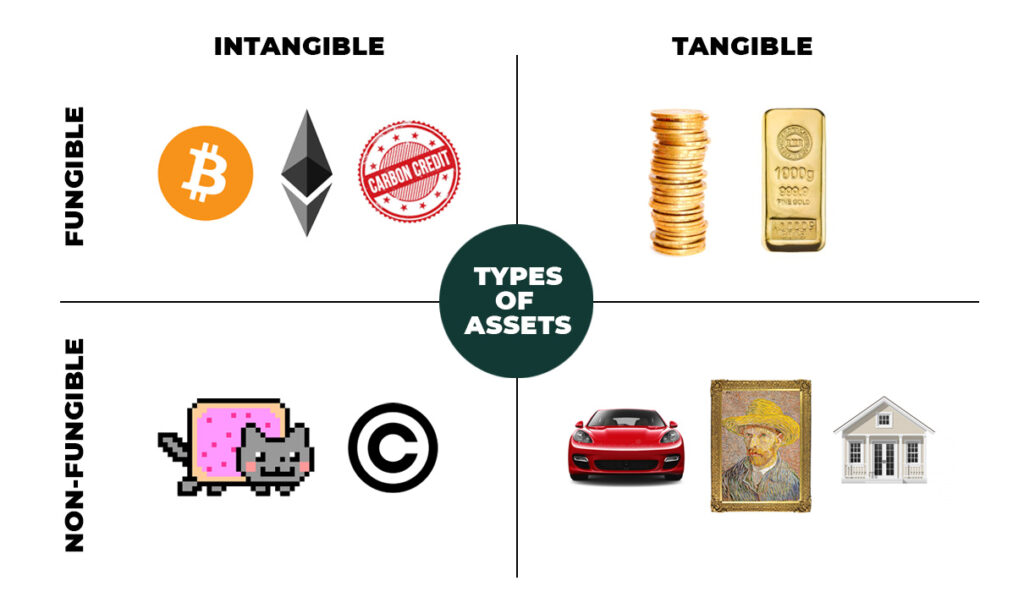

Non-fungible: a unique asset.

Token: a digital certificate stored on a blockchain.

Fungible assets, such as dollars or gold, are mutually interchangeable and hold exact value when exchanged — for example, swapping a $10 note for two $5 notes.

Non-fungible assets, such as paintings or houses, cannot be exchanged interchangeably — for example, two Van Gogh landscape paintings from 1890, though similar in aesthetics and value, are unique and unexchangeable.

What’s the backstory?

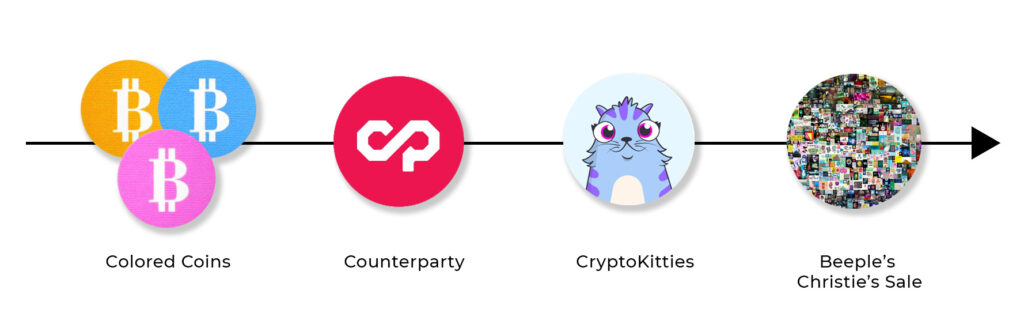

From the Counterparty platform through the CyptoKitties blockchain game and to this month’s landmark sale of Beeple’s artwork, NFTs have only risen in profile and popularity.

Colored Coins are often considered the conceptual spark for NFTs. Beginning in 2012, these small denominations of Bitcoin were used to represent assets from digital collectibles and property to company shares.

Next came Counterparty in 2014, a peer-to-peer financial platform on the Bitcoin blockchain that became a hub for digital asset creation and trading (memes and trading cards thrived).

NFTs hit the mainstream in 2017 with CryptoKitties, a blockchain game in which players adopt, rear, and trade virtual cats (so popular it significantly slowed the Ethereum blockchain).

2021’s manic demand for NFTs can be explained through a confluence of factors:

- After years of growth, cryptocurrency investors are looking to diversify portfolios.

- Pandemic lockdowns saw homebound creators and collectors invest more time and money in NFTs ($250 million of NFT volume traded in 2020, up 300 percent year-on-year).

- Emerging NFT marketplaces (see below) have become more user-friendly, bringing in new collectors.

- Celebrity interest (Grimes, Mark Cuban, Lindsay Lohan, etc.) has generated huge hype.

How and where are NFTs traded?

Rarible, OpenSea, and Nifty Gateway are among the many user-friendly marketplaces that have made crypto art easy to buy, sell, and search for.

NFTs are created, bought, and traded on the blockchain, predominantly Ethereum’s. To participate, users use a digital wallet and create an account on one of many of marketplaces including:

Rarible — a Moscow-based platform and currently the world’s largest marketplace. It’s centered on supporting artists producing affordable art, with the average transaction per user standing at $129.

OpenSea — one of the first decentralized NFT marketplaces and currently the second largest. Considered by some as the eBay for NFTs, OpenSea platforms millions of assets across hundreds of categories including trading cards, domain names, digital art, and virtual worlds.

Nifty Gateway — focused on fine art and collectibles it terms “Nifties,” its prominence is soaring off the power of platforming celebrity “drops.” Somewhat uniquely, users are not required to own or deal with cryptocurrency and can conduct purchases using a credit card.

Why is the art world excited about NFTs?

On the collecting side, the emergence of easily navigable online platforms invites a younger generation into the art world by opening up an alternate, less intimidating, and transparent market. However, as Christie’s demonstrated through selling Beeple’s NFT work “Everydays: The First 5000 Days,” the traditional gatekeepers are watching closely and don’t be surprised if major auction houses begin gobbling up NFT marketplaces.

For artists, the technology promises to protect the uniqueness and provenance of work, therein preventing forgeries which promises to also benefit galleries and collectors. In addition, artists create smart contracts for NFTs through which they can guarantee royalties from future sales — 10 percent is the industry standard — revenue that creatives are currently cut out from under the existing auction house system.

Are NFTs here to stay?

Novelty, celebrity promotion, and a sense of scarcity have garnered unprecedented attention upon a previously niche corner of the crypto-universe and in so doing turned digital assets into desirable collectables.

NFTs are a logical throughline of inherently fungible cryptocurrencies and in this respect are here to stay. The extent to which the NFT market can continue its gangbuster growth and unsettle traditional practices of art making and trading are multibillion dollar questions.