Back in 2018, the European Investment Fund (EIF), a subsidiary of the European Investment Bank Group, joined forces with the consortium of Deloitte Digital and KEA European Affairs to provide “capacity building” to intermediaries operating under Creative Europe’s Cultural and Creative Sectors Guarantee Facility.

A fancy term for financial risk assessment, “capacity building” is an essential strategic tool for better understanding the ways micro, small, and medium-sized organizations (SMEs) function in the cultural and creative sectors (CCS). These sectors account for more than 7 million jobs in the EU, comprising over 4.2 percent of the EU’s GDP. The Cultural and Creative Sectors Guarantee Facility wields an overall budget of nearly $181 million, underscoring the EIF’s dedication to supporting the needs of SMEs in an ever-changing marketplace.

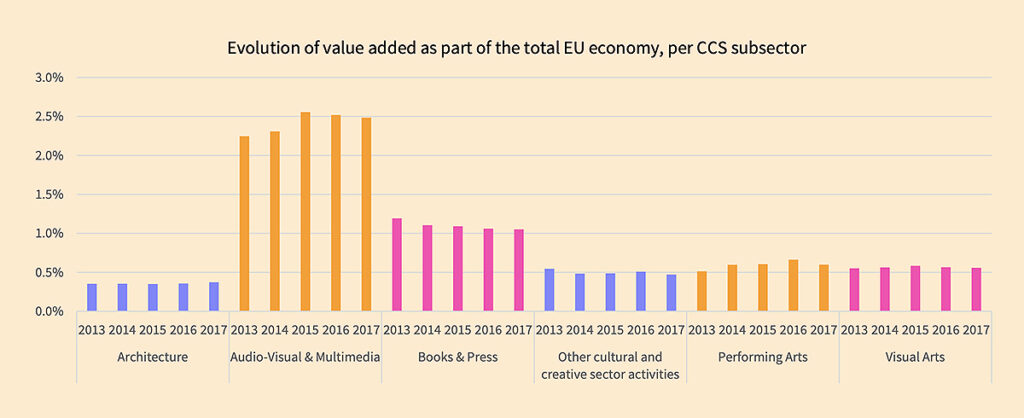

The EIF has recently released its 2021 report, Market Analysis of the Cultural and Creative Sectors in Europe, a comprehensive survey of the ways in which SMEs function and are represented across the continent. Its findings lean heavily into an increasingly digital framework for cultural consumption; the main driver of creative sector employment is the Audio-Visual and Multimedia sub-sector, which generates 2.5 percent of value for the EU economy and boasts an over 7 percent growth rate since 2013. Despite the worldwide scourge of COVID-19 and subsequent global recession, the EIF’s report speaks to an overall feeling of optimism, as technological innovation has pushed creative industries to the forefront of tourism and entertainment.

The biggest sub-sector in Europe’s CCS, Audio-Visual and Multimedia sub-sector represents almost 48 percent of the overall value-add generated by the sector. Image: European Investment Fund

News on the visual arts front feels particularly upbeat: as digital sales of artworks continues to rise amid pandemic closures, the Visual Arts workforce has still managed to expand at a compound annual growth rate of 3.9 percent, accounting for 0.6 percent of the overall value added to the EU economy. This is important intel for museum professionals and arts workers — the art industry, while temporarily bowed, doesn’t appear to be snapping anytime soon.

Here’s a breakdown of the report’s trend takeaways for 2021.

Digitalization increases access to cultural content and drives growth

Cultural heritage institutions like museums, libraries, and archives are exerting enormous effort towards the digitization of their collections. Europeana, Europe’s designated digital heritage platform, boasts a range of over 58 million records from over 3,600 institutions. During the pandemic, 70 percent of museums increased their use of social media, while ratcheting up their relationships with augmented reality and virtual options — the British Museum made interactive 3D objects available to their audience through SketchFab this year, for instance, and the Museo Nacional Thyssen-Bornemisza in Madrid offered a virtual tour of its latest Rembrandt exhibit, complete with interactive guide.

Cooperation is key

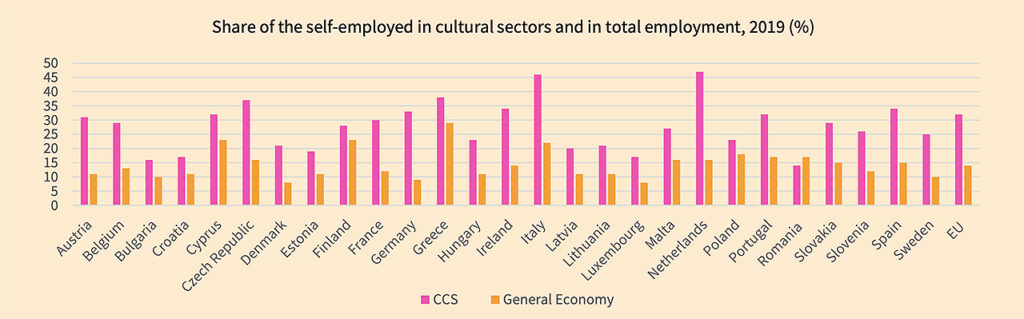

An average of 32 percent of CCS workers are self-employed, compared to 14% in the overall economy. Image: European Investment Fund

New forms of cross-sector collaboration are drawing the curtain on CCS fragmentation and supporting fresh new approaches to audience engagement. This sentiment reflects the self-employment figures of creatives in Europe; on average, 32 percent of CCS workers are self-employed, and in places like the Czech Republic and Germany, the numbers are even higher. Freelancers, micro-companies, and project-based assignments benefit European creative industry players by allowing an increased flow of ideas and heightened cooperation.

Thought leaders are promoting increased ecological sustainability

A renewed dedication to environmental awareness can best be seen in the Visual Arts and Fashion sectors, where hands-free digital sales and self-consciously green practices are becoming nearly de rigueur for new business. In general, the CCS are still in a declaratory phase of sustainable practice: Lorenzo Quinn’s “Support” sculpture in Venice, Italy, unveiled at the Venice Biennale in 2017, depicts an enormous pair of hands reaching out of the Grand Canal to hold the walls of the iconic Ca’ Segredo hotel, reminding visitors that climate change effectively lies in their hands.

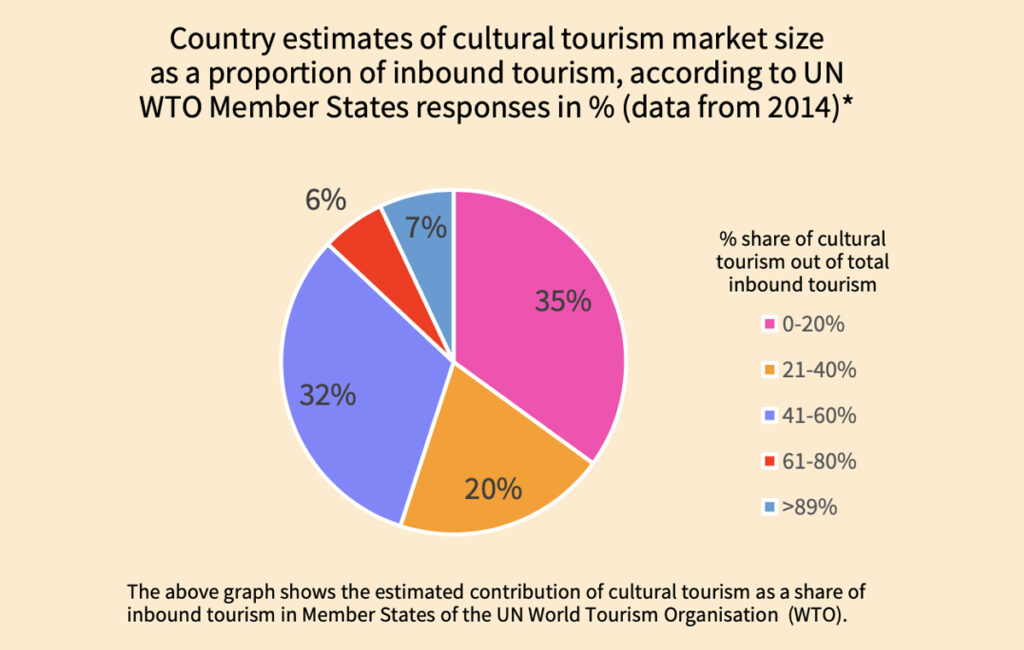

Culture is a major draw for European travel

WTO countries have reported that even if culture itself is not their primary reason for travel, tourists will often visit cultural institutions and facilities during their stay. Image: European Investment Fund

According to the World Trade Organization, almost half of the countries under its umbrella have reported that more than 40 percent of international tourists visited a country based on a specific, onsite cultural offering. Given that the COVID-19 pandemic has put a huge damper on travel, the UN has projected that earnings from international tourism may be as much as 80 percent lower than last year.

This hasn’t kept the CCS down, however, as cultural institutions collaborate with tech companies to create explore-from-home touristic experiences. For instance, Visit Flanders and the Ghent Fine Arts Museum joined forces with Belgian virtual reality company Poppr to develop a smash-hit online tour of the Van Eyck galleries, complete with a downloadable DIY paint-making kit.

New regulations lead to income generation

The revised directive on Copyright in the Digital Single Market has opened up new streams of revenue by supporting rights holders in recouping investments into production and curation. This directive empowers creatives to make decisions about where and on which platforms to be remunerated for their content, opening up opportunities to be paid for participation in unlicensed and under-licensed streaming platforms. Member States are due to absorb this directive into their national legislations by June 2021.

Cultural engagement in a post-COVID climate

In Europe and beyond, the populace at large is hungry as ever for a return to normalcy, which means that the entertainment industry is on task to provide new avenues for fun. A growing spirit of digital collaboration, bolstered by five years of modest expansion, has been kicked into overdrive, incontrovertibly proving that an appetite exists for digital tourism and cultural exchange. While we’re still sussing out what that might mean for the future of institutional engagement, the numbers don’t lie — “hands-on” doesn’t always have to be literal.