How might the Delta variant impact China’s domestic travel market? Which new consumer habits do tourism stakeholders need to stay on top of? What can be learned from Hainan’s strong COVID-era numbers?

These were among the key questions addressed in a joint webinar from travel data company ForwardKeys and Jessica’s Secret, developer of a price comparison app for Chinese tourists. Fortunately, both came armed with strong data and gave a clear picture of a market that has proven remarkably flexible and resilient in the face of unpredictable environmental changes.

“The Chinese market is changing rapidly,” offered Mirko Wang, CEO of Jessica’s Secret, “and you need up-to-date data to understand consumers and to prepare for long-term marketing.” Below, are some of the market changes Wang and Forward Keys’ Nancy Dai have noted.

Delta positivity

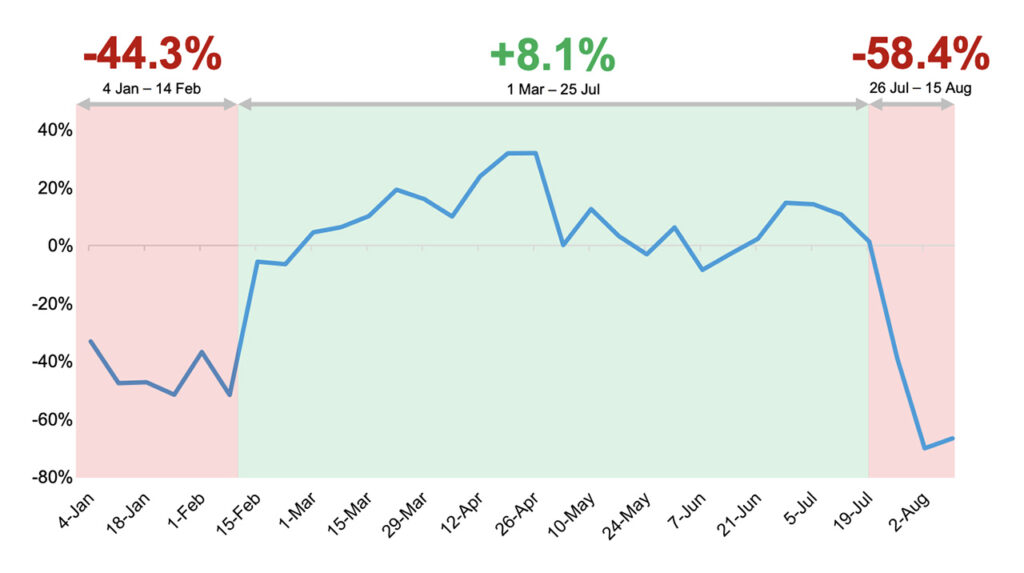

In a three-week period between July and August 2021, air ticket sales saw a 58 percent drop compared to 2019 figures — the year’s largest dip yet. Source: ForwardKeys Air Ticket Data

The sudden appearance of the Delta strain, which spread from Nanjing to a dozen provinces causing travel curbs, urban lockdowns, and mass testing, dented the sense of China’s impenetrability. Domestic travel suffered immediately with tickets issued between July 26 and August 15 falling 58 percent compared to 2019 and many predicting a slowing of internal movement in the coming months. ForwardKeys, however, takes a more optimistic outlook, citing the government’s ability to contain outbreaks and therein restore consumer confidence as proof that travel numbers will quickly restore.

Key Quote: “We believe Chinese travel will rebound after the outbreak is brought under control. Look at Chinese New Year — it was badly affected by COVID but came back quickly when high and medium risk areas had been cleared in late February.” — Nancy Dai, Insight Expert, ForwardKeys

The emergence of “influencer destinations”

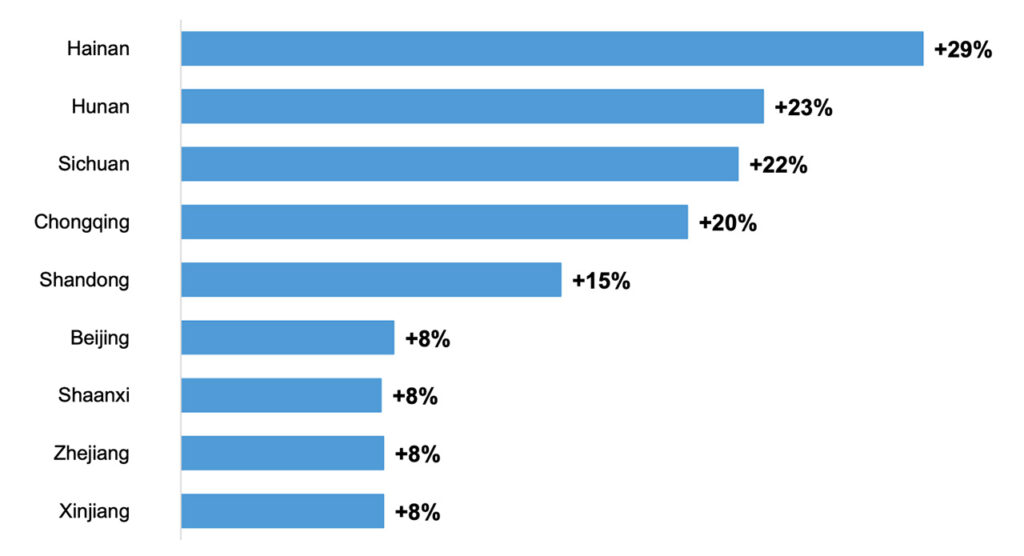

Exposure on Chinese social media platforms has seen lesser-known destinations such as Hunan and Sichuan grow in popularity, chalking up at least 20 percent increases in air arrivals, compared to 2019 numbers. Source: ForwardKeys Air Ticket Data

The historical sites of Beijing and Xi’an have long made the cities stalwarts of China’s tourism industry, ones reliably packed over the national holidays. But the past 18 months have seen the strong emergence of less traditional destinations, such as Changsha, Chengdu, and Chongqing, whose allure is built on trendy food scenes and their connections to celebrity culture. Flight data bears this out with summer arrivals to Beijing growing 8 percent over 2019 numbers compared to 23 and 22 percent increases in Hunan and Sichuan respectively.

Key Quote: “Places frequently mentioned on platforms such as Little Red Book and TikTok — their popularity is strongly boosted by influencer posts.”— Nancy Dai, Insight Expert, ForwardKeys

The limits of Hainan’s duty free

In July 2020, Hainan introduced a host of measures intended to incentivize duty-free shopping on the southern island province. The annual spending allowance was raised, the single purchase limit removed, and seven new categories added. Sales duly rose 127 percent. Some speculated Hainan’s success could hamper the prospects of global duty-free retailers and outbound destinations accustomed to benefitting from Chinese shoppers. Wang offered a positive, but more cautious picture, particularly in respect to Hainan’s cross-border e-commerce business which retains a 5000 RMB ($774) limit that has proved prohibitive for luxury goods.

Key Quote: “Since the pandemic, the consumption focus [in Hainan] has shifted, China has approved cross-border e-commerce, but it doesn’t yet meet the needs of consumers and it’s price sensitive. But P&C [perfumes and cosmetics] can meet demand.” — Mirko Wang, CEO, Jessica’s Secret

Last-minute clicks

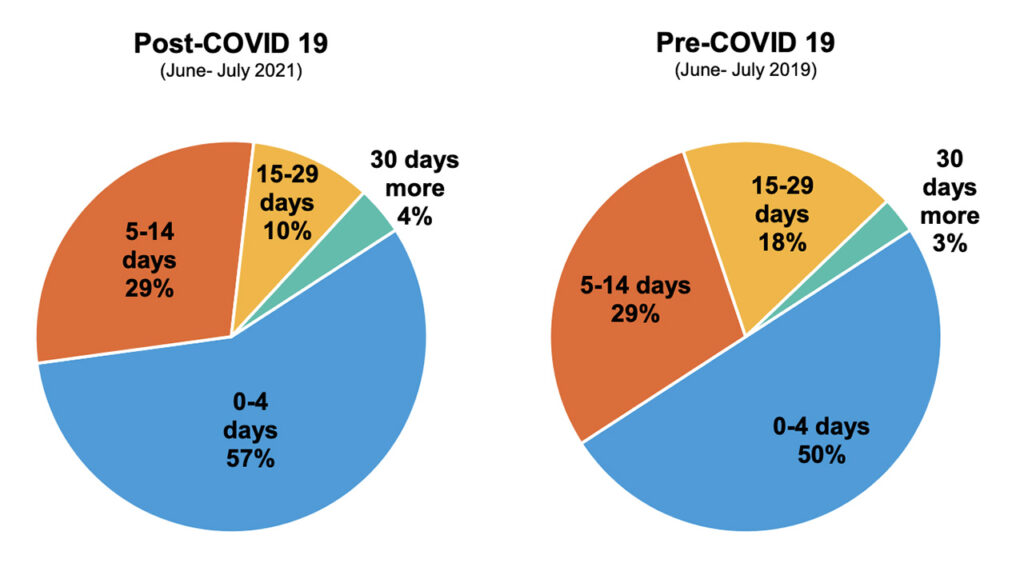

The lead time for travel bookings has grown shorter, in part due to the volatility of travel regulations and COVID resurgences. Source: ForwardKeys Air Ticket Data

The lead time for Chinese domestic travel bookings has shortened over the past year. The uncertainty of ever-changing coronavirus situations and regulations, paired with ubiquitous cancelation policies now offered by airlines, are primarily responsible. Consumer protection was strengthened in early August with the Civil Aviation Administration of China requiring airlines to offer travelers free refunds.

Key Quote: “It’s a key change in booking behavior. [Domestic tourists] increasingly book last minute, which means it’s likely there’s going to be a rebound for upcoming Golden Week.” — Nancy Dai, Insight Expert, ForwardKeys