Few Chinese destinations benefited as directly from the collapse of outbound tourism in 2020 as Hainan, China’s southernmost province. As domestic tourism gathered momentum in the latter months of the year, the sub-tropical island’s comfortable environment and duty-free shopping captured tourists who, in recent years, have sought out regional destinations such Bali, Phuket, and Ha Long Bay.

In December, Hainan welcomed 9.5 million visitors, its second busiest month on record, showing that China’s so-called Hawaii had recovered. What, then, are the learnings for international island destinations? This was the central question posed by “Recovery And Resilience: Chinese Island Destinations,” a webinar led by Dr. Wolfgang Georg Arlt from China Outbound Tourism Research Institute.

Here are the key takeaways from the webinar.

Connected islands

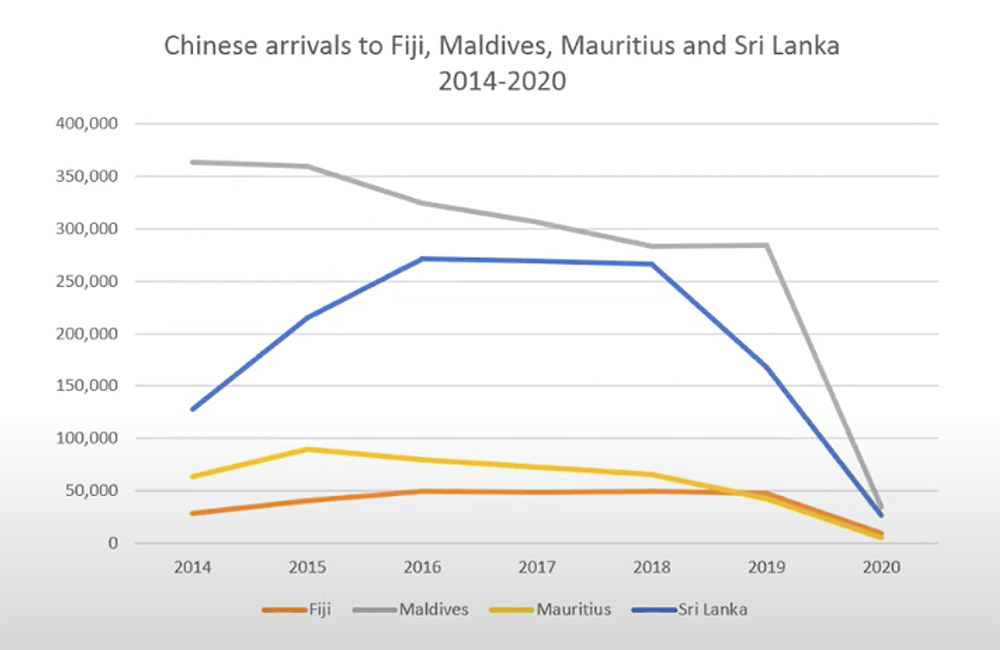

Pre-pandemic, island destinations as distant and distinct as Fiji and Sri Lanka shared similar fates in respect to Chinese tourists; positive publicity and affordable packages turned tropical islands into “hot” destinations for the first half of the 2010s. Oftentimes lacking the necessary logistical or social infrastructure to support Mainland visitors, these booms began to peak around 2015 as Chinese tourists sought out other destinations. The challenge of providing Chinese tourists diverse, quality, and culturally-sensitive experiences long predates the pandemic. Now is the moment for a rethink.

The dip in Chinese outbound travel to island destinations like the Maldives and Mauritius predates 2020. Image: China Outbound Tourism Research Institute

Key quote: “Concentrate on training and empowering local stakeholders instead of simply spending on Chinese social media [marketing campaigns]. A high level of satisfaction for guests who in turn will refer to friends.” — Dr. Wolfgang Georg Arlt, CEO, China Outbound Tourism Research Institute.

New numbers for new tourists

It’s time for destinations to establish new benchmarks and key performance indicators (KPIs) in respect to Chinese tourists, says Richard Adam, CEO at Trend Transfer. Visitor numbers are not the core objective of developing tourism, which makes their focus illogical. Instead, destinations might concentrate on creating local jobs, strengthening local retail and value chains, and bolstering sustainability (an issue increasingly as important to visitors as the destinations themselves). Next, create KPIs to measure these before tackling sales, marketing, and distribution.

Key quote: “The Chinese source market has developed and diversified over the past two decades. There’s an increasing number of experienced travelers who rate experience above price.” — Richard Adam, CEO, Trend Transfer

Hope in Macau’s rebound

Macau may not seem an ideal yardstick for measuring Chinese travel demand given its geographic and cultural proximity to China, but the autonomous region was subject to many of the same stringent travel restrictions as international destinations for much of 2020. Since first beginning to reissue visas in mid-August, Macau has welcomed an estimated two million Mainland tourists, giving substance to research suggesting two thirds of Chinese travelers are eager to begin traveling once visas are available and health safety has been re-established.

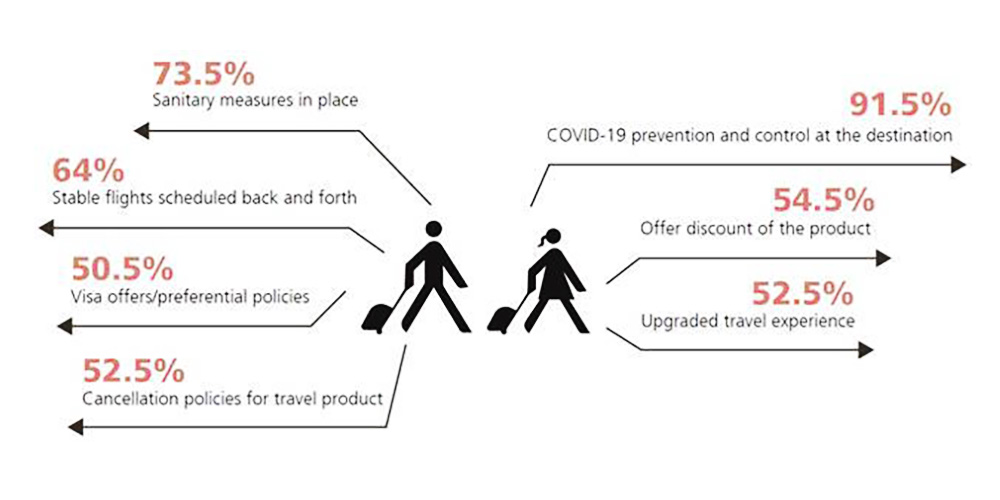

In its survey of 200 China outbound travel agencies and travel companies, the 2020 ITB China Travel Trends Report found that health and safety precautions at destinations are priorities for Chinese travelers. Image: ITB China

Key quote: “The good news is that appetite for outbound travel will likely rebound and reach 100 million in 2022. China is projected to have the second highest GDP growth in 2021, and this will impact the top ten percent — those who have a passport and are able to travel.” — Dr. Wolfgang Georg Arlt, CEO, China Outbound Tourism Research Institute

The world in 2023

Where will outbound Chinese tourism be in two years time? Here’s how the panelists answered.

Richard Adam, CEO, Trend Transfer: “Some destinations will have adapted to changes and done their homework based on the new priorities of travelers. Others will wait until it’s over, thinking everything will go back to normal. I don’t think that will happen; the cards will be reshuffled and there will be winners and losers.”

Anita Chan, CEO, Compass Edge: “I predict revenge travel will happen by the latest in 2022. From a digital side, it is difficult to know [the future] because things change so quickly. In two years’ time, new tools, new platforms may appear that can’t be predicted.”

Hans Lagerweij, President, Albatros Travel: “The market will be completely recovered by that time and China will be breaking records again. We know the demand is there, we know the money is there.”