Now in its fourth iteration, Artsy’s Gallery Insights Report typically captures a broad canvass of art business ideas, balancing the online strategies of some against the more traditional leanings of others. 2020 eviscerated such on/offline boundaries and, as the report lays bare, severely challenged those unwilling or unable to adapt: nearly 70 percent of galleries that failed to sell work (8 percent up from 2 percent in 2019) didn’t offer art for sale online.

Collecting feedback from 1,758 art businesses across nearly a hundred countries, at a glance, the report points towards a year of fundamental change for the industry. Galleries embraced digital selling strategies from online auctions to private viewings via FaceTime, the percentage of young buyers doubled, and more than a third of galleries now operate without a physical location. Closer inspection, however, reveals a more stable state of play: the percentage of large galleries stands unchanged and “outreach to existing clients” remains as the top sales strategy. Alas, even in a year of digital everything, the power of personal relationships endures.

The coming year will see gallerists, collectors, and curators integrate the lessons of 2020 within decades-long practices. Here are three significant findings from the report presented alongside insights offered at Artsy’s key findings webinar on January 29.

Developing digital channels

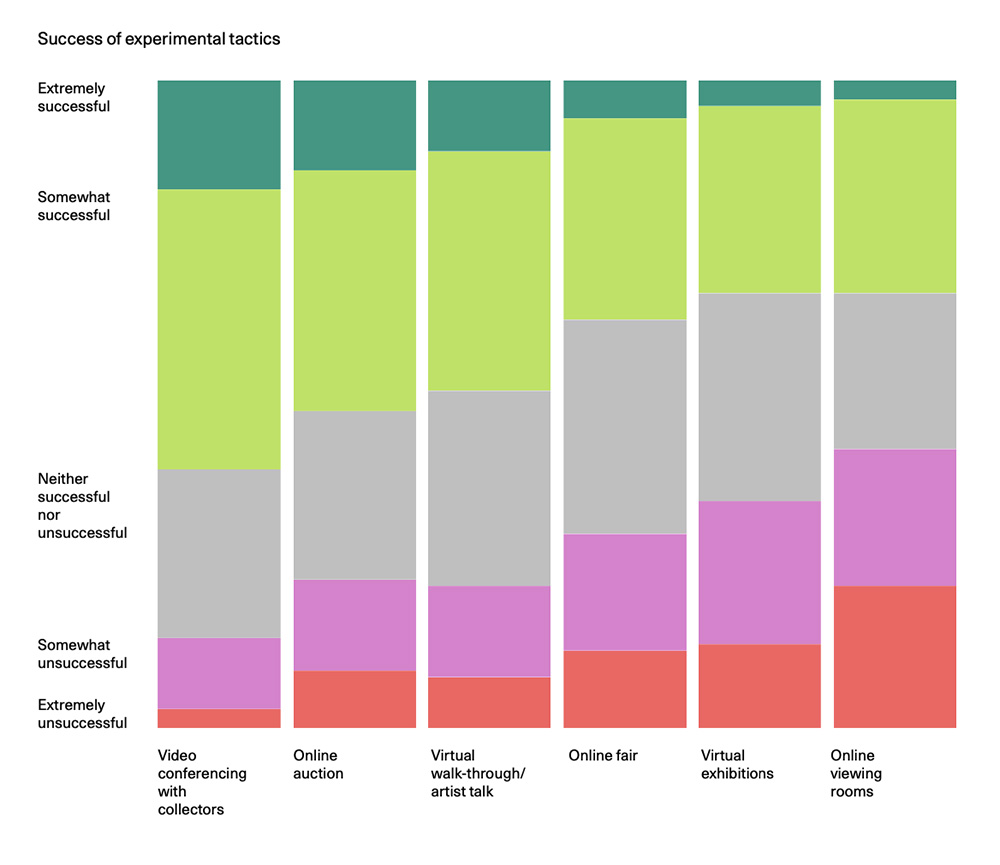

Overview in data: 34 percent of galleries took part in virtual viewing rooms, 31 percent in virtual exhibitions, and 30 percent in a virtual artist talks or gallery walk-throughs.

For a majority of gallery respondents, video conferencing with collectors and online auctions proved to be the most successful digital channels, driving sales and attracting new buyers. Image: Artsy Gallery Insights Report

- Selling art online is not new to galleries: the 87 percent of galleries that did so last year is close to 2019’s figures. What changed was the need to develop and promote online tools with 16 percent finding “great success” in online auctions, private walk-throughs, and video conferencing.

- Another facet was social media. Budgets increased 92 percent year-on-year and ranked third as a sales channel, replacing art fairs. Budgetary shifts forced by the pandemic and made possible by the disappearance of costly art fairs may not be a permanent change, but it’s certainly forced stakeholders to reassess priorities.

Key quote: “[2020] accelerated a move online and that kept a lot of galleries in business… 87 percent of gallerists are selling online and that is a pretty significant jump that has seen a broadening of the gallery audiences” — Dustyn Kim, Artsy, Chief Revenue Officer

Online-only model emerges alongside younger buyers

Overview in data: 38 and 33 percent of European and American galleries now operate with an online only business model.

- The number of galleries without a physical location grew from 15 to 35 percent in 2020 and, with it, newfound belief in the viability of such a model. 54 percent were confident in an online strategy, up 6 percent from 2019.

- Accompanying this development was the growth of younger customers, a group more comfortable with digital browsing and purchasing. Buyers between the ages of 18 and 34 grew from 2 to 4 percent, with 73 percent of galleries reporting at least half of their 2020 collectors were new customers.

Key quote: “People who have never walked into a gallery are finding it online. Galleries are tapping into the next generation of buyers, meeting them where they have been buying everything else.” — Carine Karam, Artsy, Global Head of Sales & Partnerships

Mid-sized, diverse galleries suffer most

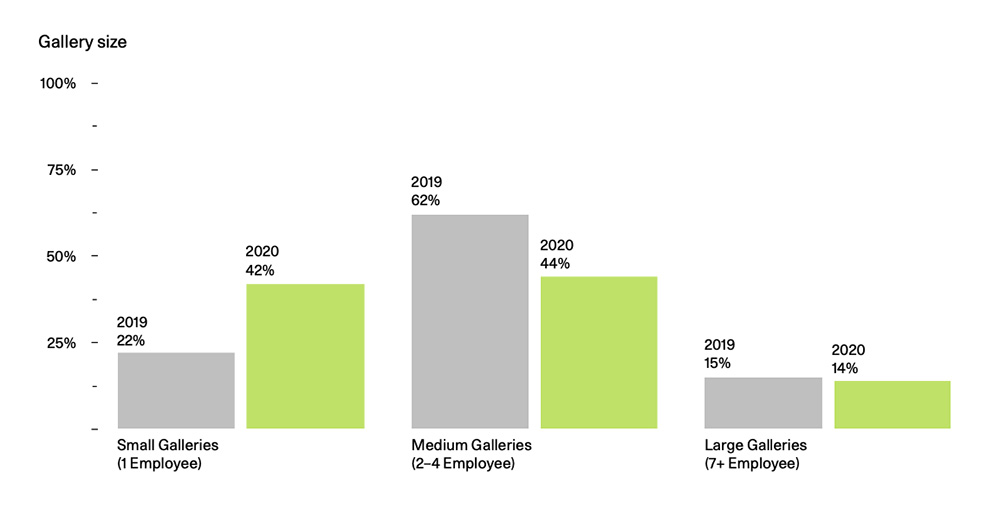

Overview in data: The number of mid-sized galleries decreased 6 percent.

Downsizing and restructuring as a result of the pandemic have hit mid-sized galleries the hardest in 2020. Image: Artsy Gallery Insights Report

- With the number of large galleries remaining constant, downsizing of mid-sized galleries saw the number of small galleries double in 2020.

- Artsy collected diversity data for the first time. It found Black, Indigenous, and people of color (BIPOC) galleries experienced a higher rate of closures over the past 12 months — 11 percent compared with 8 percent.

- From 550 respondents, the report found 13 percent note an owner or director identifies as BIPOC.

Key quote: “Closure rates at BIPOC [galleries] are an unfortunate reflection of inequality in the art world and shows the amount of work ahead to create a more inclusive industry” — Dustyn Kim, Artsy, Chief Revenue Officer