Forty years on from Deng Xiaoping’s reform and opening up push, which introduced entrepreneurship and market incentives to a state-led system, a new set of policies is reinvigorating China’s trade capabilities and foreign investment appeal. If the breakneck growth of the 1980s was most vividly captured in the Special Economic Zones of southern China, which saw sleepy fishing villages morph into gleaming metropolises, today’s equivalent may well be the glitzy shopping malls of Hainan, the tropical island province at the country’s heel.

Nearly 1,500 miles from the capital, Hainan has long operated on the periphery of the country’s economics and politics, serving instead as a relaxing getaway for an increasingly affluent Mainland market. That all changed in 2018 when the government announced the establishment of the Hainan Free Trade Zone, which is set to fully mature by 2025 in a liberalization of cross border trade, investment, and capital that could well dwarf regional competitors such as Hong Kong and Singapore.

In the meantime, targeted government policies are turning Hainan into a retail travel mecca in the hopes of vastly expanding the economy and changing domestic consumption habits. A sudden sweep of measures introduced in July 2020 made Hainan a pandemic winner with duty free sales seeing triple-digit growth despite year-on-year tourism falling by a third.

With the government labelling Hainan a “new highland of China’s reform and opening up,” recent activity is only the beginning. Timely then, the latest Moodie Davitt report should turn its focus in 2021 on Hainan in an extensive accounting that breaks down not only the macro trends at play, but speaks to the individuals and business driving development.

Here, Jing Travel breaks down three key takeaways for the broader travel sector with reflections from report’s mastermind, Martin Moodie.

Far-Sighted Government Policy Paying Dividends

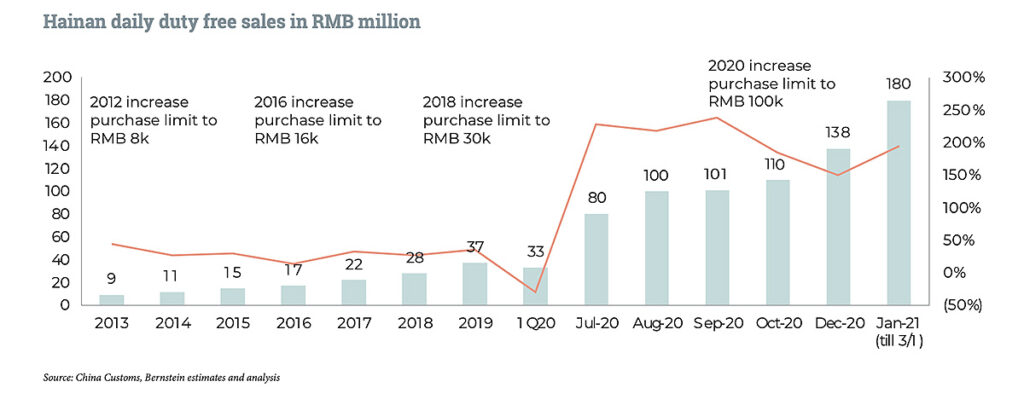

Hainan’s duty free sales have risen dramatically with every increase of the single purchase limit. Image: Moodie Davitt Report

Hainan’s generous climate and expansive beaches have seen it widely hailed as China’s Hawaii. And although the southernmost province strives to lure domestic travelers away from the tropical trappings of Thailand and Bali, targeted government policies are making it equally a competitor for duty free giants such as South Korea and Dubai.

A flurry of policies in mid-2020 evidenced a willingness to secure market competitiveness at a time of depleted international travel: it raised the annual allowance to $15,369, removed the single purchase limit, and extended the number of categories from 38 to 45. The result? Sales rose 127 percent year-on-year, pushing past the $5 billion mark.

Early 2021 has seen licenses granted to several newcomers including Shenzhen Duty Free Group and Hainan Development Holdings, developments aimed at achieving $46.5 billion in sales by the end of 2025. Little wonder the report calls Hainan’s duty free market “a beacon of light in an otherwise darkened sector.”

Martin Moodie reflects: “The enhanced offshore duty free shopping rolled out in July 2020 was the showpiece of a highly ambitious Hainan Free Trade Port Overall Plan, a masterplan designed to accelerate the creation of a Free Trade Port with ‘Chinese characteristics.’ I expect further pro-business, pro-consumer policy improvements released in line with central government policy to boost domestic consumption and repatriate Chinese travel shopping from abroad.”

China Duty Free Group Expands O2O Capability Amid Increased Competition

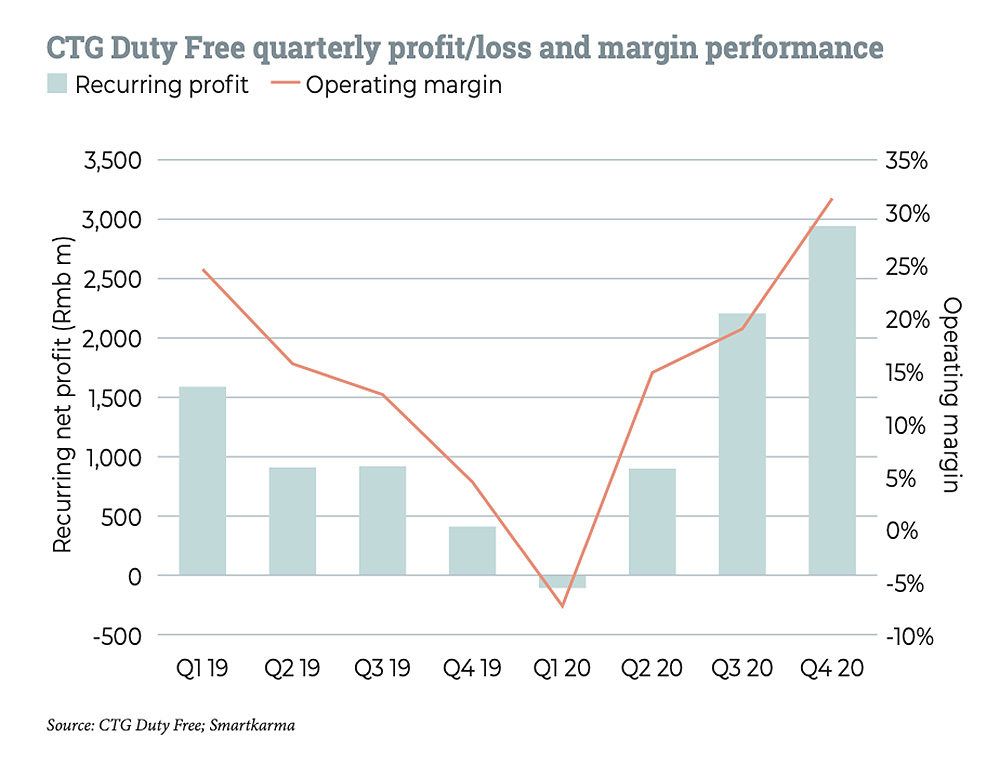

In FY2020, China Tourism Group Duty Free saw its revenues climb by +8.2% year-on-year to US$8.1 billion — a strong performance that the company attributed in part to Hainan’s enhanced offshore duty free policy. Image: Moodie Davitt Report

With an estimated 70 percent market share, China Duty Free Group (CDFG) dominates Hainan’s duty free scene. Sales of $4.9 billion in 2020 topped its own optimistic target and the prospect of tripling sales by 2022 seems possible given its already vast portfolio is set to include an expansion of its Haikou Meilan International Airport location and the Haikou Ri Yue Plaza, which will include the world’s largest duty free store when completed next year.

The report includes an extensive interview with CDFG President Charles Chen focused on the push into online to offline (O2O) marketing after a year of shifting consumer behavior. Central to this strategy is building up CDFG’s membership scheme (10 million members and counting) through which it leverages big data to create precise user portraits and offer additional purchasing services. “In the future,” Chen predicts, “online business and airport duty free shops will be roughly 50/50.” CDFG has leaned into short-video and livestreaming over the past year to attract younger consumers with Chen promising an intensification of activity on “top-tier platforms.”

The development of Hainan into a global duty free hub is drawing an increasing number of players into the market from Shenzhen Duty Free’s Haikou Mission Hills to Hainan Tourism Investment Duty Free’s Sanya International Tourism Duty Free City. Chen, however, sees the competition as a positive: “New players on the market may bring new models and creative ideas to the duty free business.”

Martin Moodie reflects: “What stands out to me is Charles Chen’s tremendous confidence in the future of Chinese travel retail and China Duty Free Group. The confidence is based on a combination of factors — firstly, the supportive attitude of the government; secondly, the rapid growth of (and professionalism in) online business. As he said, ‘The pandemic is an accelerator of the convergence between online and offline business.’ CDFG will remain the overwhelmingly dominant force; it has an amazing location in Haitang Bay and the shopping environment itself is a tourist attraction in its own right.”

Hainan’s Market Dominance May Well Endure

Hainan’s much-heralded success in 2020 may have stemmed from seizing an opportunity in the midst of a pandemic, but it’s unlikely the island’s travel retail volume will slump as other destinations come into play. For starters, it’s no coincidence new duty free-friendly policies were announced in July; rather, it signifies a concerted government effort to boost domestic spending and part of a shift to contain luxury spending within China.

As the report notes, the conveniences of traveling and spending domestically — think service, language, and ease of travel — may well set a precedent for many such that “65% to 70% of Chinese sales will be in China versus 35% before COVID.” The ongoing steps to make the whole island duty free in 2025 will further the destination’s appeal to tourists and retailers alike.

This market capitalization goes hand-in-hand with broader improvements to Hainan’s travel appeal. “Tourism infrastructure and transportation infrastructure continue to expand and improve,” says Eudes Fabre, CEO North Asia of Lagardère Travel Retail, “which raises the overall capacity and the attractiveness.” Ultimately, Fabre proposes, Hainan will move away from being a pure travel retail market.

Martin Moodie reflects: “The key to Hainan’s tourism economy will be the growth in infrastructure — general retail, hotels, leisure and entertainment facilities, restaurants, and more. Hainan is rich in natural attractions, from world-class beaches to tropical rainforests to geothermal springs. The trick, as with all island tourism economies, will be to properly balance that inherent natural allure with the infrastructure development needed to grow the sector.”