In October, Invest Hong Kong (InvestHK) held its Investment Promotion Week conference to promote blockchain and Web3 investment and business opportunities in Hong Kong. InvestHK is the government department responsible for attracting foreign investment and supporting overseas and mainland Chinese businesses looking to get started or expand in Hong Kong, working to strengthen the city’s status as an Asian Web3 hub.

Hong Kong has been bullish on Web3 and the metaverse from early on, supporting crypto pioneers and their work. For example, Animoca Brands, one of the leading game software and venture capital companies, and crypto.com were both founded and nurtured in Hong Kong.

At Investment Promotion Week, speakers from a variety of backgrounds — from government officials to company CEOs and co-founders — shared their insights and experiences.

We recently caught up with Francis Belin, the President of Christie’s Asia Pacific, to gain his perspective on the shift from physical to digital art and how auction houses are responding.

Are people moving away from physical art or equally interested in physical art, but now buying more digital art? How are auction houses responding?

We believe physical art and digital art are complementary to each other, not replacing one another. We see collectors buying digital art and also bidding/buying physical art, and vice versa.

We launched Christie’s 3.0 this September to offer the highest level of curation in the NFT art market. It is a revolutionary platform that establishes Christie’s as the first global auction house to host fully on-chain sales. We partnered with three leading companies in the Web3 community, Manifold, Chainalysis, and Spatial, to bring it to life and build an engaged digital community.

We strive to break down the boundaries between the digital and physical with our curatorial sale strategy, by offering digital art in live auctions, as well as offering hybrid art in our live auctions. We hope that by launching Christie’s 3.0, we are signaling to collectors that Digital Art deserves a place in every serious contemporary art collection.

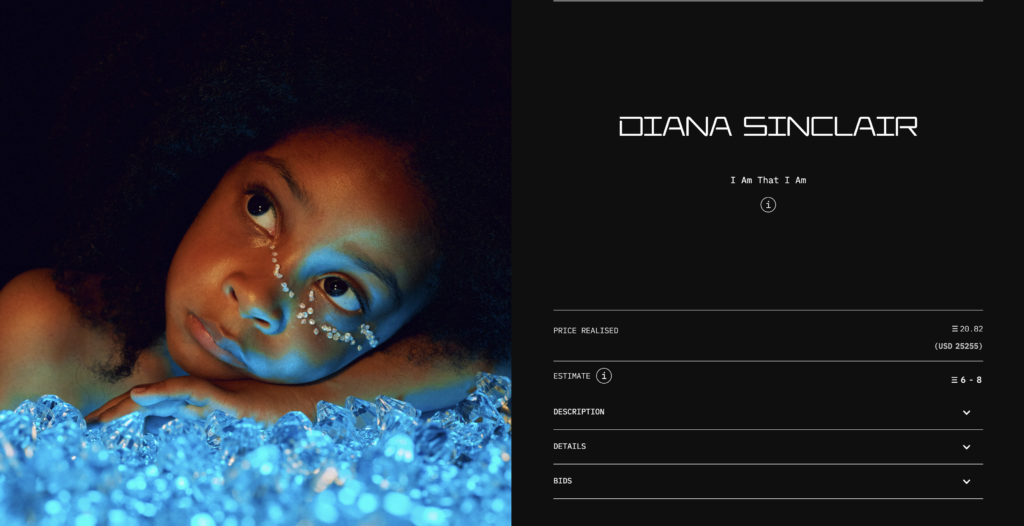

Diana Sinclair’s “I Am That I Am” sold on Christie’s 3.0 for ETH 20.82 ($25,255), well above its presale estimate of ETH 6-8. Image: Christie’s 3.0

Can you say more about where you see auction houses expanding into digital spaces post-COVID?

In the post-pandemic era, while we speed up our digital transformation for object presentation and transaction, we believe that — going forward — these two aspects will be running in a hybrid format. Meaning, both live and online-only auctions offering both digital and physical objects.

Live sales, specialist talks, and previews will be livestreamed. Other objects will be offered both online and physically exhibited in our previews by using new technologies like e-catalogs, superzoom of objects, AR, and 3D holograms to create these previews.

How is Christie’s addressing client security as it shifts to hosting auctions digitally?

We take data security seriously. We require all bidders to register with Christie’s and go through ‘Know Your Client’ checks. We additionally partner with Chainalysis to screen all wallet addresses before allowing clients to bid with us.

Like in a typical Christie’s sale, we still require and review all KYC from interested clients. We have a very high standard of operating and comply with all regulations, and we verify the identities of all consignors and bidders.

Christie’s 3.0 is an example of our commitment to the advancements in this space, as each transaction there happens fully on-chain. Web3 also addresses these fundamental needs of the market by including compliance and taxation tools, which makes for an inclusive solution where both veteran and new NFT collectors can feel secure in transacting with platforms like Christie’s 3.0.

Christie’s 3.0: www.nft.christies.com